In real estate, dates aren’t suggestions—they’re deal-makers. One missed day can mean a delayed closing, frustrated clients, rate lock issues, or worse… a blown transaction.

That’s exactly why the TRID Calendar exists.

Under the CFPB’s “Know Before You Owe” rule—formally known as TRID (TILA-RESPA Integrated Disclosure)—buyers are protected by mandatory disclosure timelines that directly impact when a transaction can legally close. Understanding these timelines isn’t optional; it’s essential for Realtors, lenders, escrow officers, and consumers alike.

What Is TRID, Really?

TRID was created by the Consumer Financial Protection Bureau (CFPB) to simplify and standardize mortgage disclosures. It replaced older, confusing forms (the Good Faith Estimate, HUD-1, and TILA disclosures) with two clear documents:

- Loan Estimate (LE)

- Closing Disclosure (CD)

The goal? Transparency, clarity, and no last-minute surprises.

The Two Disclosures That Control Your Closing

1. Loan Estimate (LE)

Provided within three business days of loan application, the Loan Estimate outlines:

- Loan terms

- Interest rate

- Monthly payment

- Estimated closing costs

This allows buyers to shop, compare, and understand their loan early—before they’re emotionally or financially locked in.

2. Closing Disclosure (CD)

The Closing Disclosure is where timing becomes critical.

Federal law requires the CD be received by the borrower at least THREE business days before signing. Not hours. Not “about three days.”Three full business days.

This rule gives buyers time to:

- Review final numbers

- Compare them to the Loan Estimate

- Ask questions or dispute discrepancies

And yes—the clock matters.

Why the TRID Calendar Is a Game-Changer

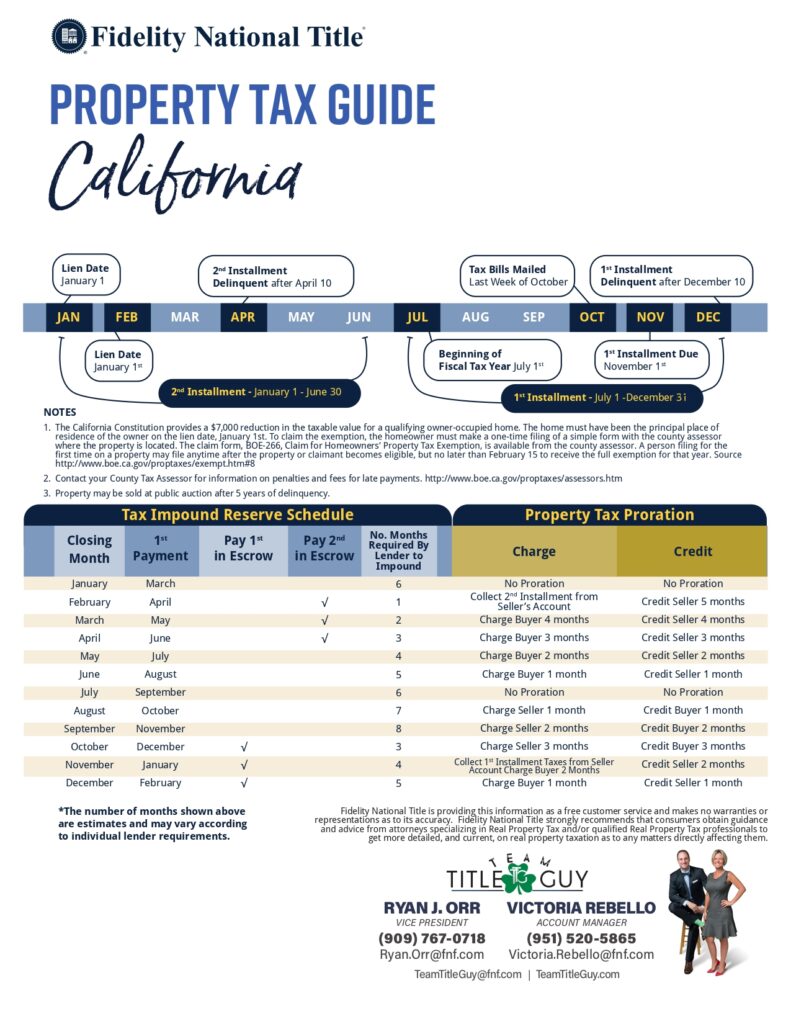

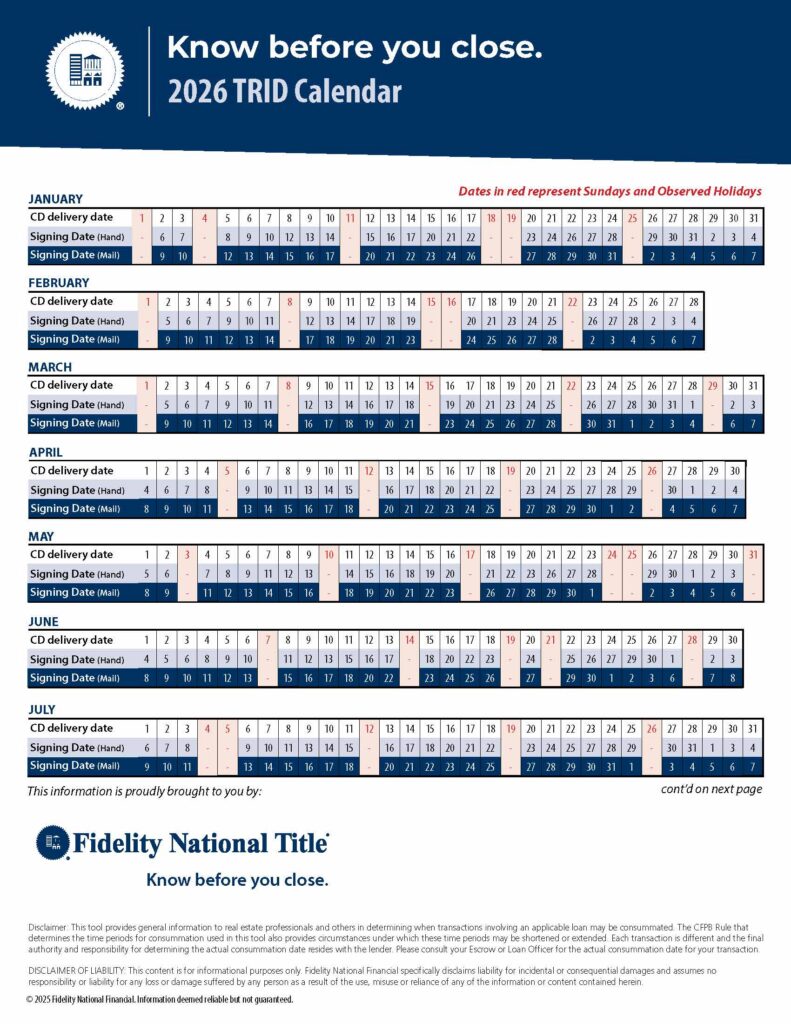

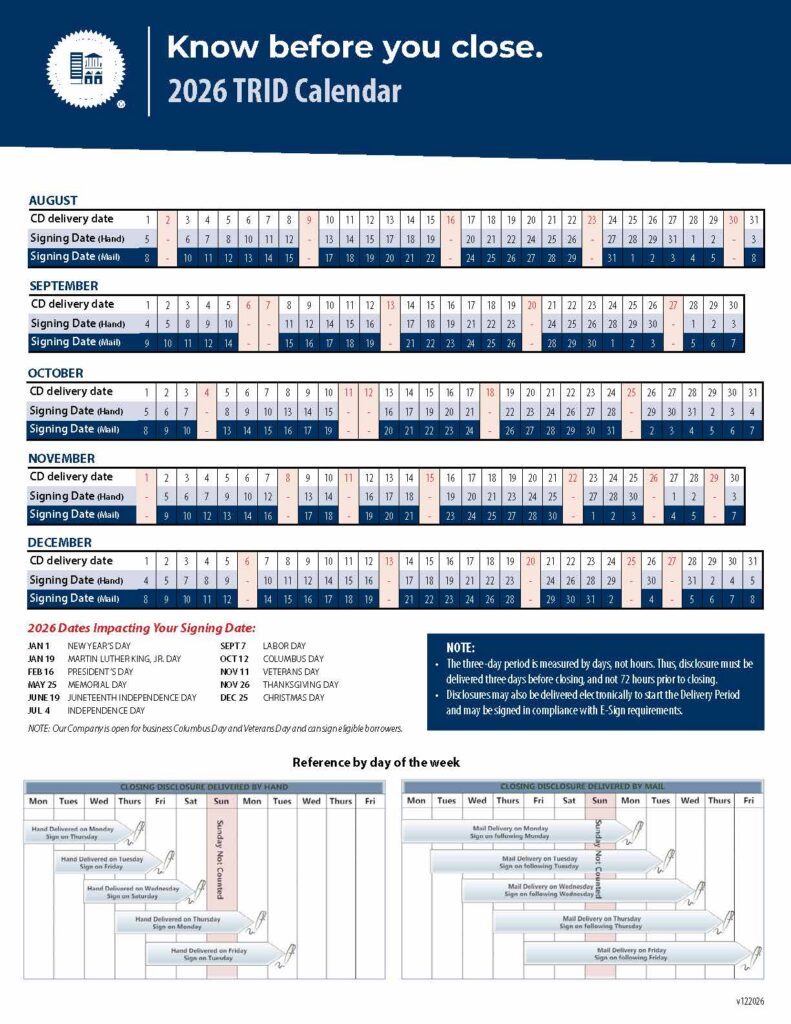

The TRID Calendar visually maps out:

- When the Closing Disclosure must be delivered

- Whether it’s delivered electronically, by hand, or by mail

- How weekends and federal holidays affect the timeline

For example:

- A CD delivered by mail adds three additional business days

- Sundays and federal holidays do not count

- The“three-day rule” is measured in days—not 72 hours

These nuances are clearly illustrated in the 2026 TRID Calendar provided by Fidelity National Title, including month-by-month delivery and signing scenarios.

How TRID Directly Impacts Real Estate Closings

Here’s where deals either stay smooth—or get bumpy:

- Contract close dates must account for CD delivery timing

- Last-minute loan changes can reset the TRID clock

- Rate lock expirations can be affected by miscalculated dates

- Poor planning creates unnecessary stress for buyers and sellers

Experienced professionals plan backward from the signing date, not forward from contract acceptance.

Why Team Title Guy & Fidelity National Title Matter

At Team Title Guy, powered by Fidelity National Title, we don’t just open escrow—we protect timelines.

Our team works closely with Realtors and lenders to:

- Calculate accurate TRID delivery dates

- Identify potential timing conflicts early

- Educate agents and clients before problems arise

- Keep escrows compliant, predictable, and on schedule

In a market where consumers are cautious and details matter more than ever, expert title and escrow guidance is a competitive advantage.

Bottom Line

TRID isn’t red tape—it’s consumer protection. But without proper planning, it can derail an otherwise solid transaction.

Know the rules. Respect the calendar. Work with professionals who live in this space every day.

If you want clean closings, confident clients, and fewer surprises, make sure your title and escrow partner knows TRID inside and out.

And yes—we do.

Require proof of payment, or

Require proof of payment, or Hold funds upon request until the payment posts to the county records.

Hold funds upon request until the payment posts to the county records.