Some things are bigger than business.

Some moments call us to stand together as a community. 🇺🇸💚

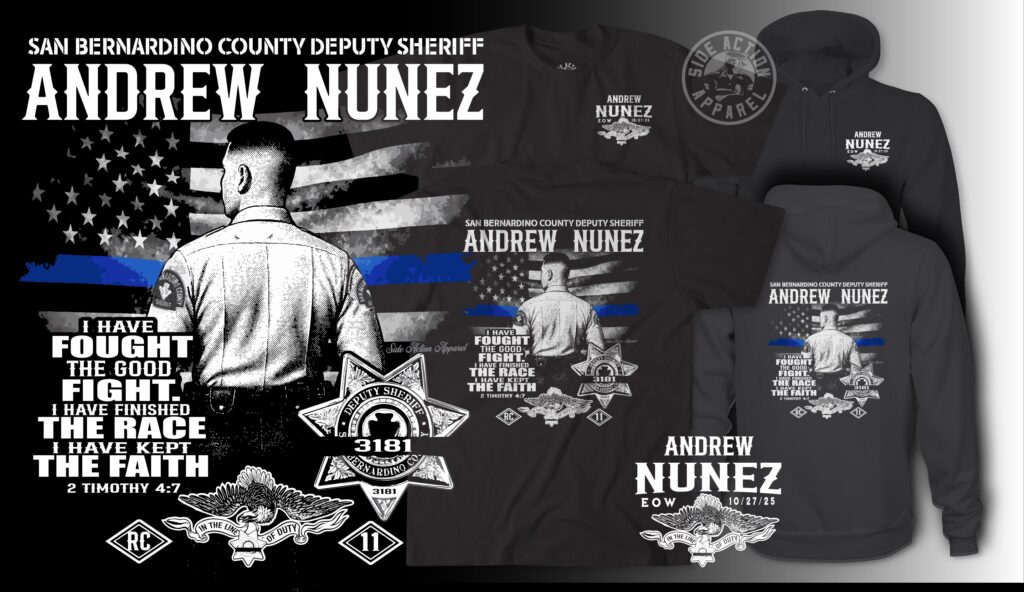

We are honored to share that we are pre-selling “Share the Honor” T-shirts and sweatshirts in memory of Deputy Nunez ahead of our St. Patrick’s Day fundraiser.

This is more than apparel.

It’s a statement.

It’s respect.

It’s remembrance.

👕 T-Shirts: $30

🧥 Sweatshirts: $45

Every purchase helps support Deputy Nunez’s family and reminds them that their sacrifice — and his service — will never be forgotten.

Whether you plan to attend the event or not, we would love your support. Wear it proudly. Wear it in honor. Wear it as a reminder that our community shows up for its own.

VENMO @Titleguy

Shirts are $30 Hoodies are $45 Include your size(s) You can text or email me and I will send you a receipt. They will be available the day of the event and or after!

📍 St. Patrick’s Day Celebration

March 17

Ace’s Corner Lounge – Upland

Hosted by the West End Real Estate Professionals

Let’s come together for a great night, a meaningful cause, and a powerful show of unity.

If you’d like to reserve a shirt or sweatshirt, message me directly.

Let’s honor him well. Let’s rally for his family.

Community is strongest when it stands shoulder to shoulder. 💚

Event Info