Understanding California’s Property Tax Cycle

As we roll through November, it’s officially property tax season in California — and if you own real estate, your first installment is due now. Property taxes become delinquent after December 10th, which means any unpaid balance after that date will start accruing penalties and interest.

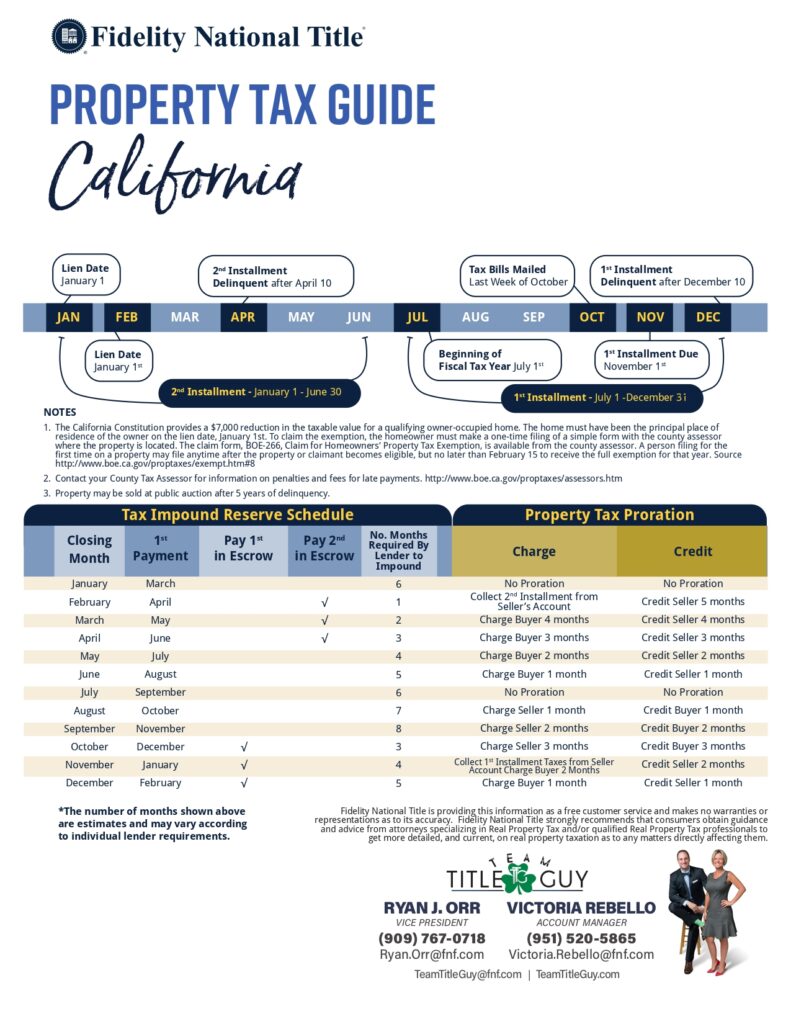

According to the Fidelity National Title Property Tax Guide, tax bills are typically mailed out the last week of October, and the first installment covers the period from July 1st through December 31st. The second installment, due in the spring, covers January 1st through June 30th and becomes delinquent after April 10th.

How This Impacts Pending Escrows

If you’re a Realtor, lender, or homeowner in escrow right now, here’s a key reminder:

If your escrow is scheduled to close before the property tax payment shows as “paid” on the county website — even if you’ve already mailed or submitted the payment — the escrow company must treat those taxes as unpaid.

In that situation, your title and escrow team will either: Require proof of payment, or

Require proof of payment, or Hold funds upon request until the payment posts to the county records.

Hold funds upon request until the payment posts to the county records.

This protects both the buyer and seller from future liens or unexpected tax obligations — and ensures the title remains clear through closing.

Avoid the December Rush

It’s always better to pay early and verify payment has cleared before your closing date.

Visit your county treasurer-tax collector’s website to confirm payment status or to pay online.

- Due Date: November 1st

- Delinquent After: December 10th

- Penalty: 10% of the unpaid amount

Don’t let a small delay become a big headache!

Your Trusted Partner in Real Estate

At Fidelity National Title and Team Title Guy, we work hard to keep your transactions smooth, compliant, and on time — from title searches to prorations and tax verifications.

If you’d like a copy of our California Property Tax Guide, or want to learn how title and escrow teams can help prevent surprises at closing, contact us anytime.

Bonus Reminder — Operation Community Cares

This Saturday, November 15th, we’re packing care boxes for our deployed service members through Operation Community Cares — “sending a bit of home for the holidays.”

Join us or donate here:  OperationCommunityCares.org

OperationCommunityCares.org