Hey friends, Ryan Orr here—your go-to Title Guy at Fidelity National Title and leader of Team Title Guy. You already know I’m big on education, clarity, and making real estate simple where we can. But there’s one thing that still catches a lot of folks off guard in California real estate…

📢 Transfer Taxes.

Yes, those sneaky little numbers at the bottom of the closing statement can pack quite a punch—especially in cities that add local city taxes on top of the county rate. So let’s break it down and help you stay one step ahead.

🧾 The Basics: What Are Transfer Taxes?

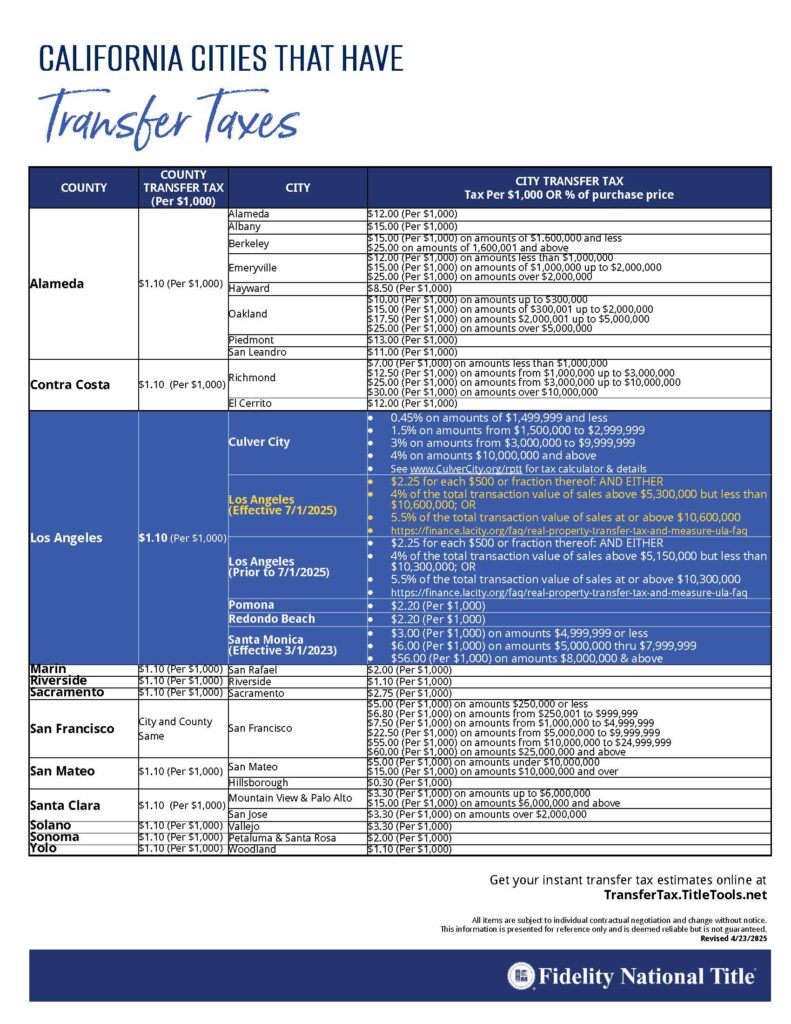

A transfer tax is a government fee charged when real property changes hands. In California, nearly every county charges a base rate—typically $1.10 per $1,000 of sale price.

But some cities? Oh, they decided to get a little fancy.

🏙️ City Transfer Taxes: Who’s Tacking on More?

Check out these examples:

- Los Angeles (Effective 7/1/2025):

- 4% for sales over $5.3M

- 5.5% for sales over $10.6M

- Plus the standard 0.45% city base tax and LA County’s $1.10 per $1,000

🧠 Translation: On a $12M sale, taxes alone could total over $727,000.

- San Francisco:

- $15.00 per $1,000 on properties between $5M–$10M

- Up to $60.00 per $1,000 for properties above $25M

- Berkeley, Oakland, Santa Monica, Culver City, and others each have their own rate ladders. Some are flat fees, others scale with the price tag.

🗺️ From Alameda to Yolo, these city-specific rates vary wildly. And it’s easy to miss if you’re only thinking about the county rate.

🤯 Why This Matters for Realtors and Clients

Imagine your client is selling a $6M home in Culver City and didn’t factor in the 3% city transfer tax. That’s $180,000. Add in county tax? You’re looking at over $186,000 in just transfer fees.

Whether you’re on the buy or sell side, surprises like that kill deals. Educated clients = smooth escrows.

💡 The Solution: Be Proactive, Not Reactive

✅ Use the tools at your fingertips. At Fidelity National Title, we’ve made it easy: 👉 TransferTax.TitleTools.net

There, you’ll find the most up-to-date rates, broken down by city and county. Perfect for net sheets, listing prep, and avoiding closing table chaos.

🔥 Call to Action:

If you’re a Realtor, investor, or buyer in CA, this isn’t just “nice to know”—it’s need to know.

📲 Let’s connect and walk through how to spot these costs early, educate your clients, and use tools like FidelityAgent ONE and TitleTools to calculate with confidence.

🎯 Remember: At Team Title Guy, we’re not just here to close deals—we’re here to build relationships, educate, and help you WIN.